Try Salesforce Starter Suite for free.

Unite marketing, sales, and service in a single app. Try Salesforce Starter Suite today. There's nothing to install. No credit card required.

Get the latest from Salesforce.

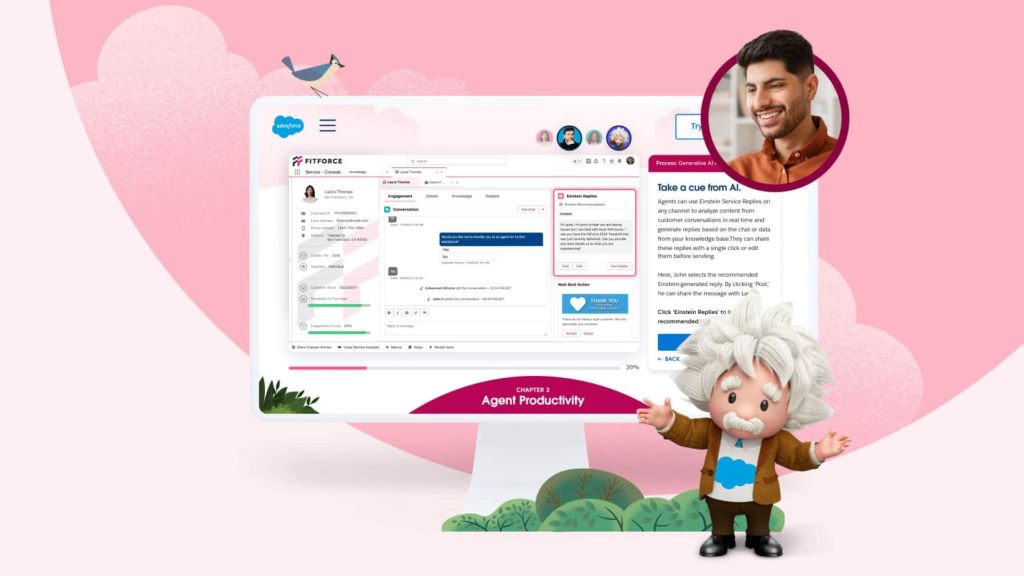

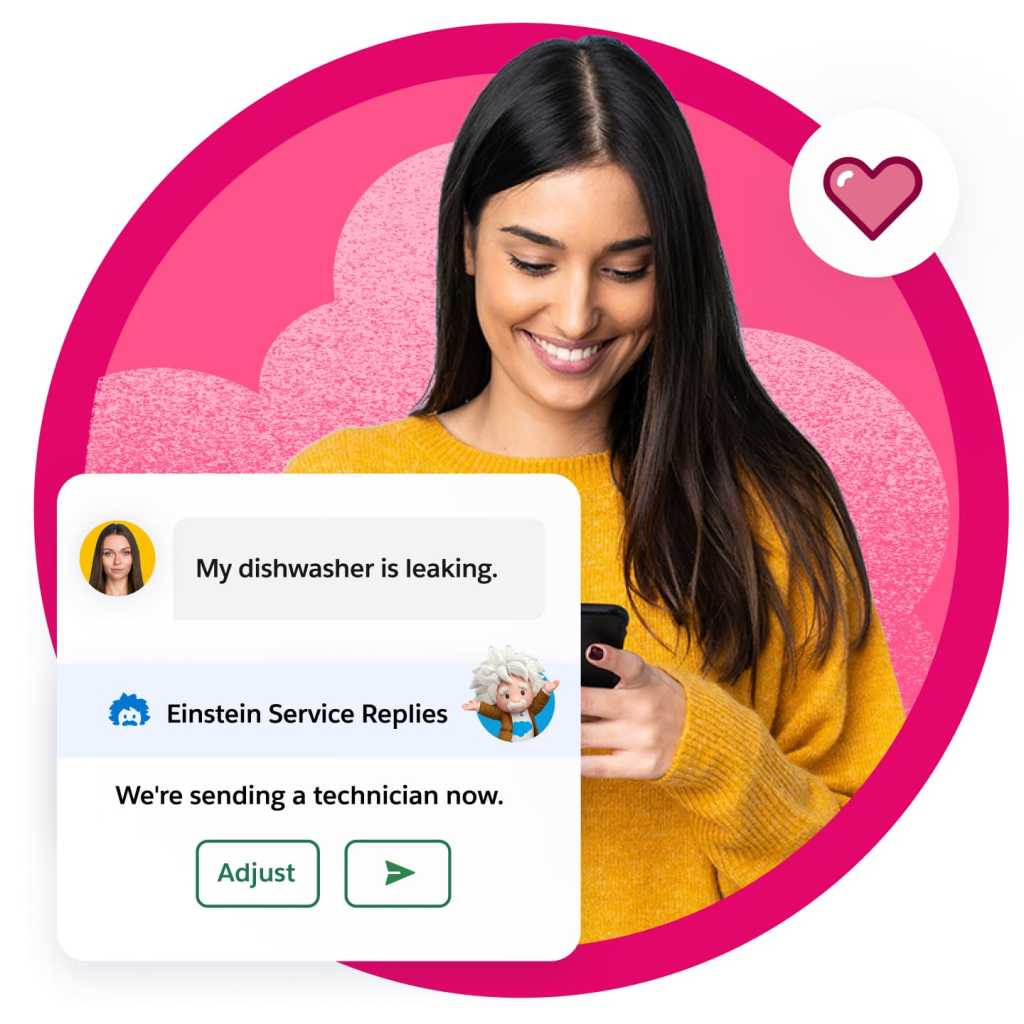

Power up every team with CRM, trusted AI, and data.

Learn how Salesforce CRM, powered by the trusted Einstein 1 platform, helps everyone at your company be more productive and grow customer loyalty.

Find innovations for any industry.

Whatever your industry, we offer solutions to modernize your business, save time, and lower costs.

See how companies drive customer success in a whole new way with Einstein 1.

Learn valuable skills for free, with Trailhead.

All sorts of content. All to help you grow.

What is CRM?

Learn all about CRM, how it can unify all your teams, and how it drives growth and productivity across your business.

Read our latest State of Sales Report.

Stream our Connections video series.

Inspiring events. In-person and streaming.

Meet and collaborate with Trailblazers who share your role and interests.

Discover apps and expertise to extend Salesforce.

Browse our AppExchange marketplace, with thousands of customized apps and specialized consulting partners to help any sized business craft a perfectly tailored Customer 360 solution.

Ready to take the next step with the world’s #1 AI CRM?

Start your trial.

Try Salesforce for free. No credit card required, no software to install.

Talk to an expert.

Tell us a bit more so the right person can reach out faster.

Stay up to date.

Get the latest research, industry insights, and product news delivered straight to your inbox.